Semiconductor giant Broadcom delivered explosive third-quarter results with record revenue of $16 billion, driven by a 63% surge in AI semiconductor sales and the announcement of a massive $10 billion AI infrastructure order from an unnamed customer widely speculated to be OpenAI.

Record-Breaking Q3 2025 Financial Performance

Broadcom reported stellar third-quarter fiscal 2025 results that exceeded all Wall Street expectations. The company achieved record revenue of $15.95 billion, representing a 22% year-over-year increase. Adjusted earnings per share reached $1.69, beating analyst estimates of $1.65.

CEO Hock Tan emphasized the company’s strong performance across key segments: “Broadcom achieved record third quarter revenue on continued strength in custom AI accelerators, networking and VMware”. The company’s adjusted EBITDA surged 30% to $10.7 billion, reflecting strong operational leverage and representing 67% of total revenue.

Free cash flow reached a record $7.0 billion, up 47% year-over-year, demonstrating the company’s exceptional cash generation capabilities. Broadcom returned $2.8 billion to shareholders through dividends during the quarter and declared a quarterly dividend of $0.59 per share.

AI Semiconductor Revenue Acceleration

The standout performance came from Broadcom’s AI semiconductor division, which generated $5.2 billion in revenue, marking a remarkable 63% year-over-year growth. This represents the tenth consecutive quarter of robust AI-driven growth.

Tan projected even stronger performance ahead: “We expect growth in AI semiconductor revenue to accelerate to $6.2 billion in Q4, delivering eleven consecutive quarters of growth, as our customers continue to strongly invest”. This would represent approximately 66% year-over-year growth for the fourth quarter.

The semiconductor solutions segment overall reached $9.17 billion, up 26% year-over-year and accounting for 57% of total revenue. Infrastructure software, bolstered by the VMware acquisition, contributed $6.79 billion, growing 17% year-over-year.

Mystery $10 Billion AI Customer Sparks OpenAI Speculation

The most significant development from Broadcom’s earnings call was the announcement of securing over $10 billion in AI infrastructure orders from a new, unnamed customer. The timing and scale of this deal has fueled widespread speculation that OpenAI is the mystery customer.

This speculation gained credibility following a Financial Times report that OpenAI is working with Broadcom to develop custom AI chips, with the first chips expected to ship in 2026. The partnership would help OpenAI reduce its dependence on Nvidia’s processors by developing its own custom accelerators.

J.P. Morgan analysts, who believe OpenAI is indeed the new customer, called this a “turning point” that will “materially increase” Broadcom’s AI revenue outlook for fiscal 2026 and beyond. The deal adds a fourth major hyperscale customer to Broadcom’s roster, joining existing clients Google, Meta, and ByteDance.

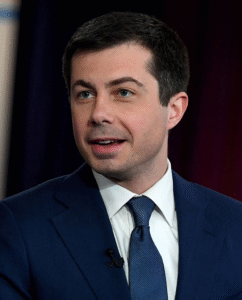

CEO Hock Tan Extends Leadership Through 2030

In a move that further bolstered investor confidence, Hock Tan announced his commitment to continue as CEO through at least 2030. Tan, who has led Broadcom since 2006, stated: “The board and I have agreed that I will continue as the CEO of Broadcom through 2030, at least. These are exciting times for Broadcom and I’m very enthusiastic to continue to drive value for our shareholders”.

Under Tan’s leadership, Broadcom’s stock has achieved a staggering 26,750% surge since the company went public in August 2009. Bernstein analysts noted: “Hock must see a runway here as he renewed his contract… suggesting he sees something worth sticking around for”.

Stock Performance and Market Reaction

Broadcom’s shares experienced dramatic gains following the earnings announcement, with the stock jumping over 10% and reaching new all-time highs. The stock traded as high as $356.34 during the session, marking a new all-time intraday high.

Year-to-date performance has been exceptional, with shares gaining 46.09% in 2025 and 147.23% over the past 52 weeks. The company’s market capitalization has surpassed $1.6 trillion, making it one of the most valuable technology companies globally.

Trading metrics highlight the stock’s momentum:

- Best four-day stretch since April 2025, up 13.89% over four consecutive days

- Best weekly performance at 13.89% since April 2025

- Best performer in both the S&P 500 and Nasdaq 100

Strong Q4 2025 Guidance and Future Outlook

Broadcom provided robust guidance for the fourth quarter of fiscal 2025, projecting revenue of approximately $17.4 billion, representing 24% year-over-year growth and exceeding Wall Street estimates of $17.02 billion.

The company expects adjusted EBITDA to remain at 67% of projected revenue. AI semiconductor revenue is forecast to reach $6.2 billion, continuing the accelerating growth trajectory.

Looking ahead to fiscal 2026, analysts project AI revenue could reach $20 billion in FY25 and $33 billion by 2026. Forbes analysts suggest the stock could potentially reach $600, representing a doubling from current levels, if the company maintains its premium valuation and continues delivering exceptional earnings growth.

VMware Integration and Software Performance

The infrastructure software segment, primarily driven by the $61 billion VMware acquisition completed in November 2023, delivered solid results with $6.79 billion in revenue. This represents 43% of total revenue and 17% year-over-year growth.

However, the VMware integration has not been without challenges. Broadcom has implemented significant changes to VMware’s pricing, licensing, and partner programs since the acquisition. The company has streamlined VMware’s portfolio to focus on VMware Cloud Foundation and VMware vSphere Foundation.

Some observers have noted revenue declines in certain VMware segments, attributing this to Broadcom’s strategy of prioritizing profitability over market share. The company has also laid off nearly 3,000 VMware employees since the acquisition and divested non-core assets like the Carbon Black security division.

Custom AI Chip Market Leadership

Broadcom has established itself as a formidable competitor to Nvidia in the custom AI chip market, designing application-specific integrated circuits (ASICs) for major cloud providers. The company’s custom accelerators, known as XPUs (eXtreme Processing Units), offer specialized capabilities for specific AI workloads.

Key competitive advantages include:

- Custom design capabilities tailored to specific customer needs

- Superior data processing efficiency for large-scale AI training and inference

- Cost advantages compared to general-purpose GPU solutions

- Long-term partnerships with major hyperscalers

Analyst Jacob Bourne from Emarketer noted: “Broadcom’s custom chips for cloud hyperscalers are well-positioned as Big Tech races to optimize AI model training and inference workloads. While Nvidia’s GPUs remain the default choice, custom solutions can deliver niche performance gains that help break through computational bottlenecks”.

The $110 billion backlog, heavily weighted toward AI infrastructure, positions Broadcom to capitalize on sustained demand for AI hardware through 2026 and beyond. With eleven consecutive quarters of AI revenue growth and accelerating momentum, Broadcom has emerged as a critical player in the global AI infrastructure ecosystem.

As the AI revolution continues to drive unprecedented demand for specialized computing hardware, Broadcom’s combination of technical expertise, strategic partnerships, and financial strength positions the company for continued outperformance in this rapidly expanding market.